Economic retrenchment and liberalization in the Nordic countries

Read about economic tendencies and policy examples that point towards the liberalization of the Nordic countries over recent decades.

Over the past two decades - and arguably for longer - the Nordic economies have had to respond to structural changes in the world economy in the wake of increasing globalization in financial and tangible goods and services, and the sovereign debt crisis in the late 2010s.

How have the Nordic countries become more liberal?

While it is a mixed bag, most commentators agree that policy making has become more liberal over the past few decades. For example, the 2020 article 'The Diminishing Power of One: Welfare State Retrenchment and Rising Poverty of Single-Adult Households in Sweden 1988–2011' describes how Sweden embarked on a policy of welfare retrenchment from the 1990s to the 2010s by cutting social expenses. The authors argue that Sweden has become a duel-earner society as a result of, amongst other things, privatizing its pension system and giving citizens more control over their earned savings, while at the same time making significant cuts to unemployment benefits. After two decades of continuous decline in income replacement and rising stringency in qualifying conditions, the country now shows decreasing healthcare provision with higher eligibility conditions, and slightly above average replacement rates. (Replacement rates for a given income level measures the proportion of benefits received when unemployed or against take-home pay when in work.) While the welfare cuts have ensured good economic recovery in the wake of the European financial crisis in the late 2010s, this performance is tainted by, for example, rising poverty levels among single-adult households since the 1990s.

Denmark’s flexicurity system combines welfare safety nets with a liberal labor market. This system is characterized by low employment protection that allows the supply side to adapt to changing market conditions and makes Danish firms more competitive internationally. The flexicurity system generates high frictional unemployment on the one hand and, on the other, off sets any ensuing welfare issues by unemployment benefit schemes (largely run through trade unions). With a focus on continuous re-skilling though training, education and welfare benefits, the flexicurity system has had the aim of allowing the unemployed to re-orient and increase their skills towards their preferred employment while insuring them against labor market changes.

Iceland has generally had a more moderately sized welfare sector, but one that has, over time, outpaced the four other Nordic countries in terms of life expectancy and infant mortality. In the 1990s, the country implemented major market liberalizations to the banking system and compensated for the growth-inhibiting effects of taxes and labor market policies. This brought about an average tax take of 36% of GDP between 2000 and 2015 compared to the Nordic average of 42.4%. However, the privatized banking system and liberalized capital markets engendered a strong capital mobility in the country and its unprecedented expansion made the central bank incapable of functioning as a lender of last resort leading to an unparalleled financial collapse that became one of the symbols of the global financial crisis. In the period from 2008 to 2011, Iceland has muddled through one of the most spectacular banking crises in history by downsizing its domestic banking sector, enforcing capital controls and entering into a stand-by arrangement with the IMF. As Iceland has parted ways with excessive deregulation and liberalization, its welfare state has doubled its social expenditure for income support in the years 2007-2016.

Has welfare spending in the Nordic countries really decreased?

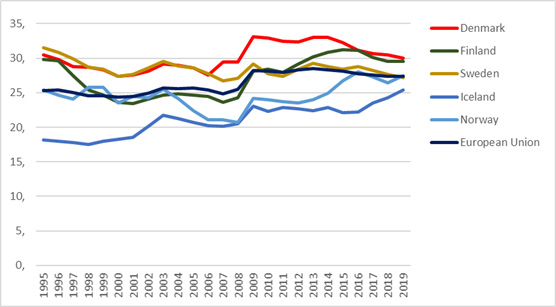

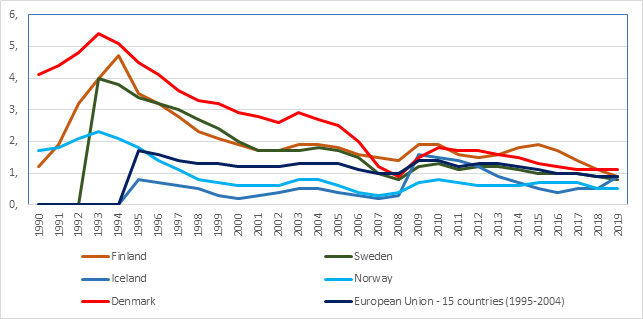

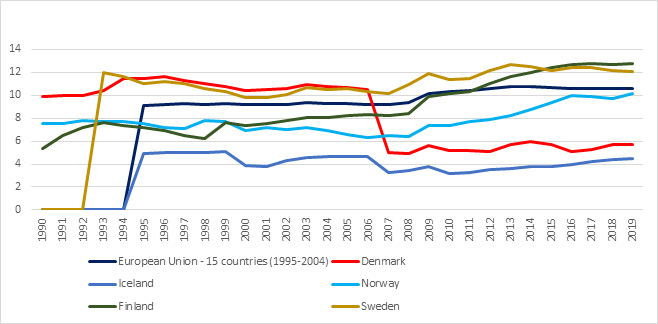

Despite some important variation, a review of different types of state expenditure from 1990 to 2019 does indeed reflect economic retrenchment towards the (generally lower) European norm.

Figure 1 shows a progressive convergence over time of social security spending as a percentage of GDP of the Nordic countries towards the dark blue European average line. Denmark and Finland remain two of the countries with the largest tax take in the world, which is reflected here. However, it is possible to see that they are nearing the European norm when it comes to social security spending as a percentage of GDP. Sweden has followed a similar trajectory to the EU since around 2009, and Iceland's recent economic history outlined above is also reflected in this overview.

Figure 2 shows how unemployment benefit schemes have experienced significant retrenchment over time in most of the Nordic countries, which are gradually converging towards the mean of Europe’s member states.

Despite significant differences across the Nordic countries, the European mean has generally outpaced most of the Nordic states for GDP expenditure on old age schemes as can be seen in Figure 3.

In recent decades, then, it would seem that the Nordic countries have been moving closer to the EU average in terms of economic freedom and social spending. More recently, there have been major changes, both in terms of welfare state retrenchment and labor market reforms. With some important exceptions, it is possible to argue that social policy has become more liberal over this time period.

Further reading:

- Susanne Alm, Kenneth Nelson, et al., ‘The Diminishing Power of One? Welfare State Retrenchment and Rising Poverty of Single-Adult Households in Sweden 1988-2011’, European Sociological Review, 36, 2 (2020) pp. 198-217.