Economic development in the Nordic countries

The Nordic countries are today among the richest countries in the world measured by GDP per capita. These countries also come top in more or less every international comparison of competitiveness. This was not the case 150 years ago. In the mid-nineteenth century the Nordic economies lagged behind those of the leading industrialised nations. The economic development in these countries has therefore been swift. At the same time these countries do not resemble the ‘textbook model’ of efficiency: the Nordic economies have been marked by large public sectors, extensive and generous welfare systems, a high level of taxation and considerable state involvement. As a result the ‘Nordic model’ has received considerable international attention.

The five Nordic countries have much in common: they are all so-called small, open economies which are highly dependent on foreign trade. These countries have also been able to exploit the advantages of globalisation. But, due to their openness, they have been sensitive to international fluctuations. Until the 1980s Finland was particularly susceptible to crises, due to its heavy dependence on one single export industry, the forestry industry. Sweden and Denmark had broader economic bases earlier and as a consequence they were less vulnerable to outside shocks. In Norway, the abundance of oil and gas has smoothed out fluctuations since the 190s. Iceland did not suffer from any significant crises until 2007–2008; for instance, the country experienced full employment throughout the entire post-war period. On the other hand, the economic crisis which began in 2008 was extremely severe.

Natural resources and exports: similar traits amongst the Nordic countries

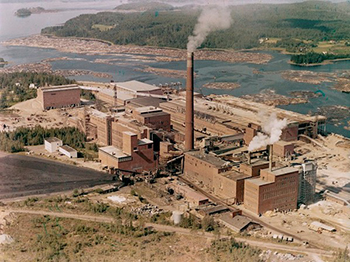

The early industrialisation of the Nordic countries was based on some key natural resources. Finland, Norway and Sweden had large forest resources, and, thus, timber and pulp and paper have been important export products. Sweden also has significant iron ore reserves, which brought wealth to the country even prior to modern industrialisation. Norway’s most important industries have been forestry, fishing and hydropower, and since the 1970s the vast oil and gas deposits in the North Sea have enriched the country. In Iceland, fishing has been by far the most important single industry: in the early years of the twenty-first century the fishing industry has produced about 40% of the country’s export earnings and contributes to more than % of GDP. Other important natural resources in Iceland are aluminium, hydropower and geothermal power. Denmark’s resource endowment has been somewhat different. The country’s arable land made agriculture important for the whole Danish economy and as a result the food industry has also been significant.

Significant structural transformations have occurred in the Nordic countries over time. Although all the five countries are still dependent on industrial exports today, the service sector has grown rapidly and is now the largest sector. During the post-war period, new lines of business within the manufacturing sector developed and the production base broadened. In Sweden important export products in the early years of the twenty-first century are iron and steel, pulp and paper products, precision equipment (bearings, radio and telephone parts and armaments), processed foods and motor vehicles. Beside oil and gas and hydropower, Norway’s chief industries are machinery, motor vehicles, paper, pulp and wood, iron and steel products, and chemicals. Finland’s main industrial branches today are the telecommunications and electronics industries. Wood, pulp and paper, basic metal industries and engineering are, however, also important branches. Denmark is a net exporter of food industry products and energy, but some other industries, such as pharmaceuticals, have also been significant for some time.

Like Norway and Sweden, Finland has large forest resources, so timber, pulp and paper have been important export products. Finland's main industrial branches today are telecommunications and electronics. Photo: A chemical pulp and consumer board factory in Kaukopää, Finland. Courtesy of Lusto, the Finnish Forest Musem (Aarne Pietinen Oy/Lusto/Finnish Forest Industries Federation’s collection).

Economic developments in the Nordics after the Second World War

These countries’ development paths have also diverged in some respects. Denmark and Sweden had a considerably higher standard of living in the nineteenth century than Finland, Iceland or Norway. The industrialisation of Denmark and Sweden started in the early part of the nineteenth century and became rapid in the late nineteenth century, while the other three countries’ industrialisation is considered to have begun only in the latter part of the nineteenth century. Even in the late nineteenth century some Swedish companies, like SKF (originally Svenska Kullagerfabriken), Ericsson, Asea (until 1977 Allmänna Svenska Elektriska AB) and Alfa Laval were world-leaders. Denmark too had several big internationally competitive companies in the early twentieth century. In Finland, the pulp and paper industry remained the most significant export industry up until the 1990s, when export of ICTs grew at a remarkable speed.

The Nordics during the stagnation of 1970s

After the oil price shock in autumn 1973 and the collapse of the Bretton Woods system, most developed economies went into recession and a period of prolonged slow growth. Among the Nordic countries, Sweden and Denmark in particular experienced stagnation.

| Denmark: Denmark, on the other hand, had suffered from persistent balance of payments deficits and high inflation since the 1960s. The public sector had also grown in an uncontrolled fashion and continuing budget deficits were a problem. When Denmark became a member of the EEC in 1973, exports and foreign direct investment flows were boosted, but in the short-term, deregulation and opening-up of the market also aggravated some of the imbalances. In the mid-1980s the country adopted a tight economic and structural programme, the so-called ‘potato cure’. Tax increases and policies to curb private consumption and investments were adopted. Labour markets were made more flexible, leading to the famous Danish system of ‘flexicurity’. By the end of the 1980s the Danish economy had recovered. |

| Finland: Finland also experienced a severe recession in the mid-1970s, but its extensive trade with the Soviet Union meant that it suffered less during the 1970s and 1980s from a weakening trade balance, which was a common problem in many other western countries after the oil price shocks. The Finnish trade with the Soviet Union was based on bilateral trade agreements, specifying that imports and exports had to be in balance. As Finland primarily imported crude oil from the Soviet Union, the rising oil prices meant automatic increases in exports. In the 1980s prior to the collapse of the Soviet trade, the trade account showed a growing surplus for Finland. |

| Norway: In Norway, too, the economy stagnated during the 1970s recession, and some industries suffered severely from crises. The country was also hit by a financial and real estate crisis in the 1980s. The problems were offset by the petroleum industry, however, which grew rapidly after the discovery in 1969 of oil reserves in the North Sea. |

| Sweden: Sweden suffered from structural problems, with the shipyards and mining industry particularly severely hit by the 1970s crises. The development of productivity was slow and the public sector expanded swiftly. The country resorted to two devaluations in the 1970s, which boosted exports, but the overall recovery was slow and as a result the famous ‘Swedish model’ was increasingly questioned. |

Liberalisation and deregulation in the Nordics, 1980s to 2000

By the mid-1980s all the Nordic economies had recovered and the economies boomed. In the 1980s a more market-based system, with liberalisation and deregulation, was also adopted in these countries which boosted development further. However, the rapid deregulation of the financial markets in particular triggered credit expansion and led to over-heating in the real estate markets; stock prices rose and asset-price ’bubbles’ were created. At the same time competitiveness suffered due to inflationary pressures and over-valued currencies. When an international economic recession hit in the early 1990s, it had devastating effects on these small open economies. In Finland the situation was aggravated by the collapse of the Soviet Union, which caused the important Soviet trade to vanish within a few months. Finland and in particular Sweden suffered from high interest rates, and in the end both countries had to resort to big devaluations of their currencies. The result was a sharp decline in exports, a collapse in the housing market and in asset prices, and a wave of bankruptcies. A severe banking crisis and a deep and prolonged economic crisis occurred in both countries. The other Nordic countries also experienced a slow-down, but to a lesser extent. Norway was, however, hit by a banking crisis.

The recovery from the 1990s crises was remarkably rapid, and a period of favourable development for all the Nordic countries began in the mid-1990s. Exports recovered rapidly in Sweden and Finland, as a result of the depreciation of those countries’ currencies. The two countries became members of the EU in 1995 and this also affected trade flows positively. Simultaneously, new industries, especially in the telecommunication and ICT sectors, expanded swiftly, with new national ’flagships’ like Ericsson (Sweden) and Nokia (Finland). In Sweden, too, other large-scale multinationals, like IKEA and Hennes & Mauritz, were triumphant on the global markets. The oil, gas and hydropower sectors continued to make the Norwegian economy blossom, and Denmark developed favourably due to some successful businesses in the traditional agri-business, and also in the pharmaceuticals, maritime shipping and energy industries.

These four Nordic countries adopted stricter economic policies in the 1990s, with low inflation targets and a focus on sound government finances. This strengthened the recovery. Bank supervision was strengthened to avert the risk of new financial bubbles. In Norway oil revenues were invested in a fund to secure them for future generations.

| When the international financial crises hit the world in 2007-2008, the Nordic countries – apart from Iceland – were less affected than many other countries. |

The Nordics: not as heavily affected by the 2007-2008 financial crises as elsewhere

When the international financial crises hit the world in 2007-2008, the Nordic countries – apart from Iceland – were less affected than many other countries. The Finnish economy experienced a severe slump in 2008 when GDP fell by more than 7% and the recovery was slow, as a decade of slow growth succeeded the crises. During 2017-2018 the economy has boomed again. The financial crises cut Danish GDP by 0.9% in 2008 and 4.7% in 2009, but in 2010, the economy recovered and has developed quite favourably since then. The Norwegian and Swedish economies contracted in 2009, but both countries experienced a strong rebound in 2010 and the economies have developed quite favourably since the crises. Both economies have let the currency weaken to improve exports, and they were not burdened by the euro zone crises, for example. The Norwegian economy has one of the highest productivity levels in Europe, while Sweden enjoys a high labour participation rate.

| Economic crisis in Iceland: Iceland was hit by an extremely severe economic crisis. In the early years of the twenty-first century the banking sector had been privatised and liberalised, which led to a rapid expansion of the country’s financial sector. Domestic banks expanded aggressively in foreign markets, and consumers and businesses borrowed in foreign currencies. At its height, the loans and other assets of the Icelandic banks totalled more than ten times the country’s GDP. This was clearly unsustainable, and in the turmoil of the international financial crises Iceland’s three largest banks collapsed in late 2008. This led to a severe crisis in the Icelandic economy, with a decline in GDP of 6.8& in 2009 and 4% in 2010. The country’s currency, the krona, declined sharply. After 2011 a swift recovery occurred. Traditional key industries are still important, but lately especially tourism has also increased rapidly. |

Further reading:

- Gudmundur Jonsson, ed., Nordic Historical National Accounts (Reykjavík: University of Iceland Press, 2008).

- Per Hull Kristensen and Kari Lilja, eds., Nordic Capitalisms and Globalization: New Forms of Economic Organization and Welfare Institutions (Oxford: Oxford University Press, 2011).

- Steffen Andersen, The Evolution of Nordic Finance (Basingstoke: Palgrave Macmillan, 2011).

- Susanna Fellman, Martin Jes Iversen, Hans Sjögren and Lars Thue, eds., Creating Nordic Capitalism – The Development of a Competitive Periphery (Basingstoke: Palgrave Macmillan, 2008).

- Torben M. Andersen, Bengt Holmström, Seppo Honkapohja, Sixten Korkman, Hans Tson Söderström and Juhana Vartiainen The Nordic Model. Embracing globalization and sharing risks (ETLA B232, 2007).

Links:

- YouTube video explaining the Norwegian Oil fund, Handelshøyskolen BI, Oslo